Business Insurance in and around Laredo

Calling all small business owners of Laredo!

No funny business here

Cost Effective Insurance For Your Business.

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including extra liability coverage, business continuity plans and errors and omissions liability, among others.

Calling all small business owners of Laredo!

No funny business here

Cover Your Business Assets

At State Farm, apply for the outstanding coverage you may need for your business, whether it's a photography studio, a sporting good store or a music school. Agent Luis Estrada is also a business owner and understands your needs. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Call Luis Estrada today, and let's get down to business.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

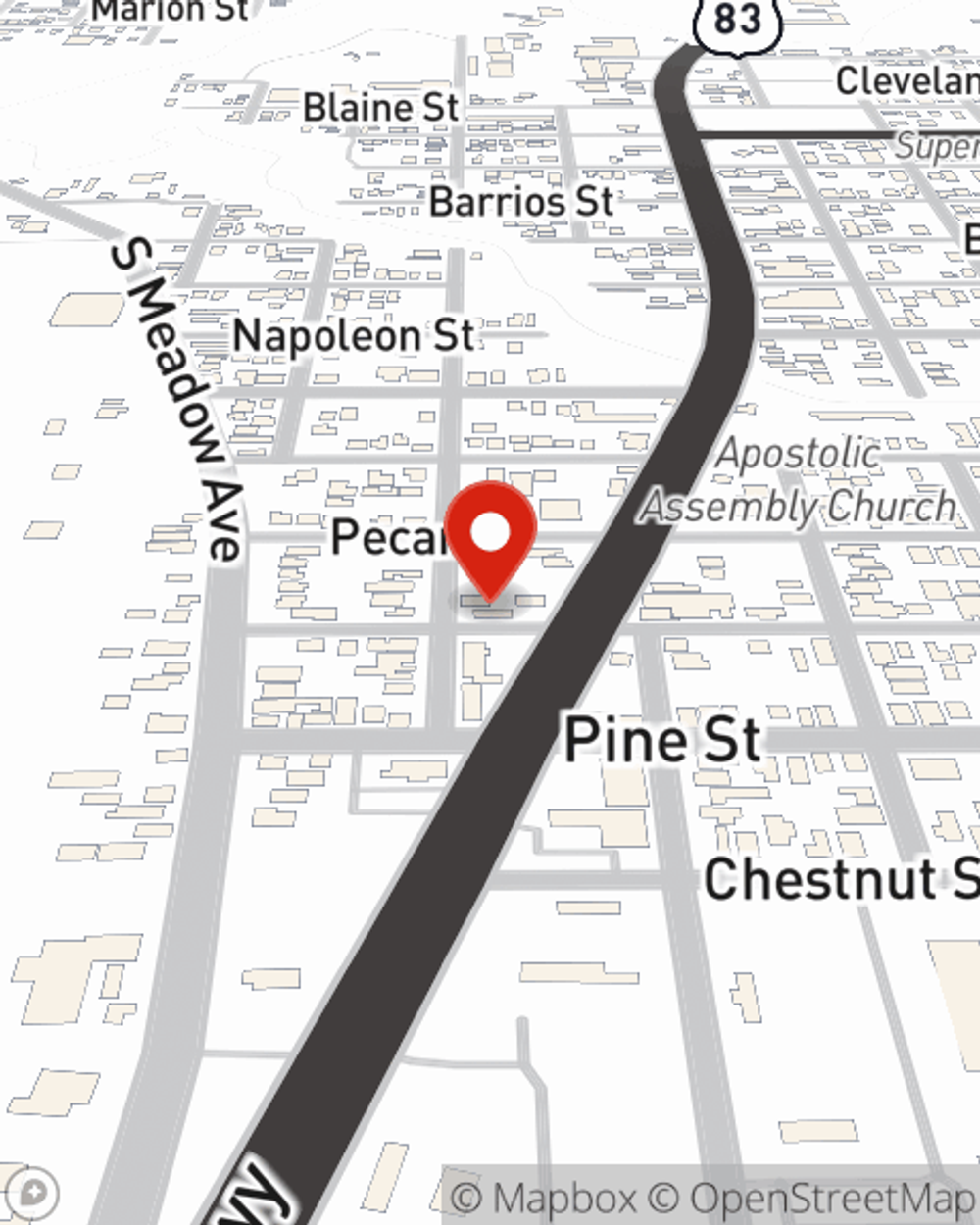

Luis Estrada

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.