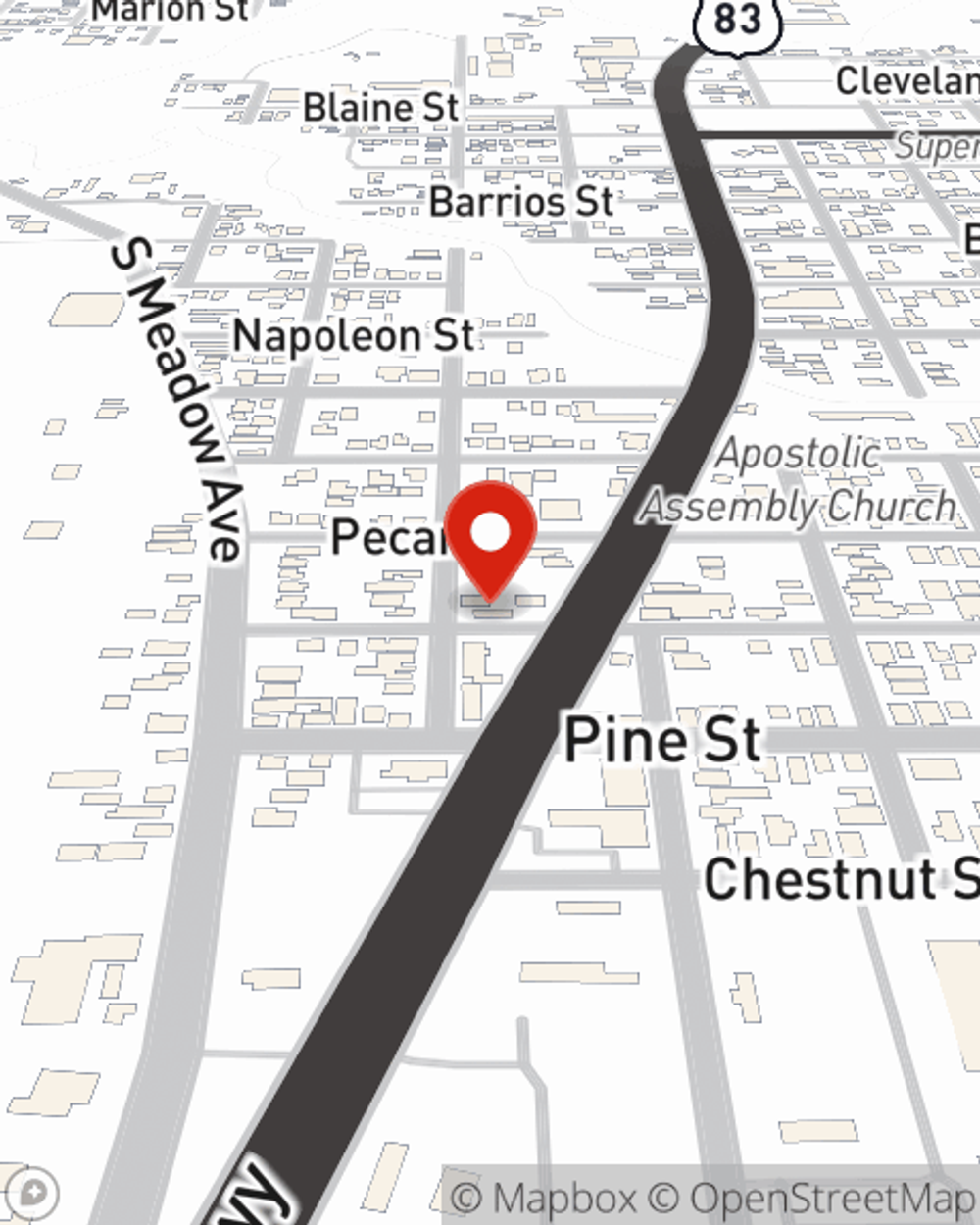

Condo Insurance in and around Laredo

Welcome, condo unitowners of Laredo

Insure your condo with State Farm today

Condo Sweet Condo Starts With State Farm

When it's time to slow down, the home that comes to mind for you and your loved onesis your condo.

Welcome, condo unitowners of Laredo

Insure your condo with State Farm today

Protect Your Home Sweet Home

You want to protect that significant place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as fire, theft or vandalism. Agent Luis Estrada can help you figure out how much of this terrific coverage you need and create a policy that is right for you.

Ready to learn more? Agent Luis Estrada is also ready to help you see what customizable condo insurance options work well for you. Call or email today!

Have More Questions About Condo Unitowners Insurance?

Call Luis at (956) 242-7086 or visit our FAQ page.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Luis Estrada

State Farm® Insurance AgentSimple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.